If you are a freelance artist, publicist or art teacher, you should apply for the Künstlersozialkasse (KSK). This guide explains how and why.

What is the Künstlersozialkasse?

The Künstlersozialkasse (KSK) is a social fund for freelance artists, publicists and art teachers. It's funded by the government, and by businesses who hire freelance artists1.

When you are a KSK member, they pay half of your health insurance, and half of your public pension insurance.

Why join the KSK?

Because it's a really good deal. The Künstlersozialkasse helps you get public health insurance and save for retirement. In most cases, it's free.

Advantages

- They pay half of your health insurance

Normally, freelancers pay 210€ to 900€ per month for public health insurance. If you are in the KSK, you pay 50% less. You keep the same coverage. - They pay half of your public pension insurance

Public pension insurance is optional for most freelancers, so you probably don't pay for it. If you join the KSK, it's required, but the KSK pays half of it. You get a public pension for half the price. - It lets you get public health insurance

Some freelancers are stuck with private health insurance, or bad expat health insurance. When you join the KSK, you can switch to public health insurance. It's often the best option for you. - It helps you get permanent residency

Before you apply for permanent residency, you must pay public pension insurance for 60 months. - It's usually free

If you earn less than 58,050€ per year, the KSK does not cost more money. If you earn more, it can cost a little more — up to 175€ per month — but it's still a really good deal.

Disadvantages

- There is a lot of paperwork

The KSK application process is a bit hard. It takes a few months to get accepted. If you don't speak German, you might need a translator. - You can't always keep your private health insurance

With the KSK, if you earn less than 64,350€ per year, you must switch to public health insurance. Most of the time, it's a good thing, but you might prefer to keep your private health insurance. More information here. - It can limit your options

If you have other sources of income, it can be complicated. You can't earn more than 450€ per month from other freelance activities (1,300€ in 2021 and 20221). You might need to refuse some contracts to stay in the KSK. You can still have a side job and stay in the KSK. - Backpayments

When the KSK accepts you, your membership starts on the date you applied. You must pay health insurance and pension insurance for the time you waited. If they take 5 months to accept you, you must pay KSK contributions for those 5 months. These backpayments can be very expensive. More information about KSK backpayments.

How much does it cost?

In most cases, nothing. You pay the same price as before, but you get more benefits.

Public pension insurance is optional for most freelancers, so you probably don't pay for it. If you join the KSK, it's required. You must pay for it.

So when you are in the KSK, you save ~9.35% of your income on health insurance, but you must pay 9.3% of your income for public pension insurance. In the end, you pay around the same price.

In other words, you save money on health insurance, and reinvest it in your pension. This is a really good deal.

| Income per year |

Normal cost Health insurance only |

KSK member cost Health insurance + pension |

|---|---|---|

| 15,000€ / year | 230€ / month | 230€ / month |

| 25,000€ / year | 390€ / month | 385€ / month |

| 35,000€ / year | 545€ / month | 540€ / month |

| 45,000€ / year | 700€ / month | 695€ / month |

| 55,000€ / year | 850€ / month | 850€ / month |

| 70,000€ / year | 900€ / month | 990€ / month |

| Over 84,600€ / year | 900€ / month | 1,075€ / month |

If you earn over 64,350€ per year, you pay a bit more. You pay up to 175€ per month more, but you contribute up to 1,311€ per month to your public pension. This is the best pension plan you can find.

Should I join the KSK?

Yes! The KSK is always worth it, except if you stay only 1 year in Germany.

If you earn more than 64,350€ per year, the KSK can feel more expensive, but it's still worth it, because you get a really cheap pension plan.

Who can join the KSK?

Freelance artists, publicists and some freelance teachers. This includes…

- Performance artists

Actors, comedians, magicians, dancers and many more. - Visual artists

Photographers, video editors, dancers, painters, graphic designers, web designers, game designers, UX designers1, illustrators and many more.- Photographers are sometimes accepted. Artistic and press photographers are accepted, but wedding and portrait photographers are not always accepted1. You must sell artistic work, not technical work1.

- Tattoo artists are almost always rejected1, 2.

- Web designers must prove that they do design, not programming or maintenance1, 2. Designing websites is art, so it's accepted. Programming and maintenance is technical work, so it's not accepted.

- Fashion designers can't sell their own clothes1. Designing clothes is art, so it's accepted. Making clothes is manual craft, so it's not accepted.

- Photographers are sometimes accepted. Artistic and press photographers are accepted, but wedding and portrait photographers are not always accepted1. You must sell artistic work, not technical work1.

- Musicians

This includes singers, DJs1, audio designers, voice actors, and many more. Your music must be the focus of the event. For example, wedding musicians are not accepted.- DJs must prove that they create art1, 2. Making music is art, so it's accepted. Playing someone else's music is technical work, so it's not accepted.

- Orchestra musicians are rarely accepted, because they are rarely self-employed.

- Wedding singers sometimes get rejected, because their music is not the focus of the event. Some get accepted. You never know.

- Publicists

This includes writers, journalists, bloggers1, 2, authors, reporters, copywriters, copy editors, YouTubers1, influencers, some translators, and many more. You must work in an artistic or journalistic context. It must require some creativity. Working on artistic texts is art, so it's accepted. Working on scientific texts is journalism, so it's accepted. In general, if you get credit for your work, it's probably artistic or journalistic enough.- Translators are not always accepted. Verbatim translations are not creative enough1, so they are rejected.

- Publishers are rarely accepted, because they are distributors, not artists or publicists. They don't create their own texts.

- Curators are not always accepted. They must make money from their own content (books, catalogues), not from administrative tasks.

- Translators are not always accepted. Verbatim translations are not creative enough1, so they are rejected.

- Teachers

This includes art, design, writing and music teachers. You must teach other people to become professional artists or publicists1. You can't only teach refugees or old people, because that's social work1.

Full list of job titles (PDF, in German)

The KSK does not accept…

- Programmers

Software developers, web developers and other IT workers can't join the KSK, because it's technical work, not art1. Bloggers and web designers can join the KSK, because they are publicists. - Artisans

If the biggest part of your job is to make things — even things that you design yourself — you are probably an artisan. The KSK might reject your application. The KSK often rejects photographers, tattoo artists and fashion designers because of this1, 2, 3.

For some professions, it's harder to apply. You need really strong proof that you are an artist, not an artisan or a technical worker. In that situation, I recommend to hire an expert to help you.

What are the KSK requirements?

When you apply for the KSK, you must prove that you meet those requirements1, 2, 3, 4. You must send a lot of documents to prove that.

You are an artist, publicist or art teacher

This means that…

- You work in an artistic or journalistic context

Creativity and originality is a big part of your work. If your work is original enough to have copyright, it should be okay. If you don't get credited for your work, it's probably not creative enough. For example, wedding singers don't work in an artistic context, so they sometimes get rejected. Some dance teachers teach fitness, not art. - It's your main job

Creative work must be the biggest part of your work, and the biggest part of your income. You can have other sources of income, but it gets complicated. - It's not temporary

You plan to do this kind of work for a long time, not just a few months1.

You make money with your work

This means that…

- You work for profit

It's a business, not a hobby. You must charge money for your services. - You make at least 3,900€ per year

You must make at least 3,900€ in profit as a freelance artist, publicist or art teacher1. In the first 3 years of your career, there is no minimum income1. After you join the KSK, your income can go below 3,900€ per year 2 times every 6 years1. There is no maximum income1. This does not apply for 2020, 2021 and 2022, because of the coronavirus pandemic.

You are self-employed

- You have many clients

You are not working for only one agency, orchestra, theatre group, film production or art school. - You are an independent worker

You are not treated like an employee. You choose how much you charge, when you work, and where you work. For example, if you have to practice with your orchestra every day, or you are an extra in a movie, you might not be independent. The KSK can reject you because of fake self-employment. It depends on many different things. - You take risks

You take entrepreneurial risks, because you are self-employed. Your employer is not protecting you. For example, if you have a seasonal contract, or you get paid even when you are sick, the KSK can reject you.

These documents explain who is self-employed, and who is not:

- The Abgrenzungskatalog (in German) — Deutsche Rentenversicherung

- Requirements for performing artists (in German) — PAP

- Requirements for music teachers — Verdi

You can be Freiberufler or a Gewerbetreibende1. It does not make a difference.

You work in Germany

This means that…

- You work from Germany

You must work from Germany at least 25% of the time, even if your clients are in other countries. You don't need German clients to join the KSK1.

All German residents can join the KSK. You don't need German citizenship. Your nationality does not affect your application.

You are not an employer

This means that…

- You have maximum one employee

You can only hire one other employee1. You can hire as many apprentices, minijob employees, and freelancers as you want1.

How to apply for the KSK?

You do not automatically join the KSK. You must apply for it. If you don't join the KSK, nobody will force you.

Is it hard to apply?

It's not that hard. If you clearly meet the requirements, then it's easy. If your case is not clear, then it's a bit harder.

You must send a lot of documents to prove that you are an artist, publicist or art teacher. This includes a resume, a portfolio, bank statements, letters of reference, reviews, contracts, invoices and more1. It takes a few days to gather all the documents.

You must do everything in German. If you don't speak German, you will need a translator1. The KSK often asks more questions, and they rarely speak English.

Staying in the KSK is easy. Once a year, you must tell them your predicted income. Each year, the KSK audits 5% of its members. If this happens to you, you must show tax declarations and other documents from the last 4 years. It's more work, but it's not hard.

How long does it take?

The KSK needs 2 to 4 months to decide, but they can take up to 1 year1, 2, 3, 4, 5, 6. If you prepare your application well, the KSK sometimes decides faster.

After you fill the registration form, you have 4 weeks to send the required documents. Then the KSK needs 2 to 4 months to make a decision. They often ask more questions, or ask for more documents.

If the KSK rejects you, you must send more documents to appeal their decision. This takes more time.

Should I pay someone to help me?

Yes. You can do everything alone, but it's easier if an expert helps you.

There are good reasons to hire an expert:

- They speak German

If you don't speak German, they can talk to the KSK for you. They can translate everything for you. - They know what the KSK wants

They quickly tell you if you qualify for the KSK. They can verify your documents, optimize your KSK application, and improve your chances of getting accepted. People often get rejected because of small mistakes. Experts help you avoid those mistakes. - They tell you exactly what to do

They give you clear instructions and tell you exactly what documents you need. They can explain everything to you. It makes the application process less confusing.

Step 0: Get your residence permit

If you need a residence permit to work in Germany, get that first. Apply for the KSK after you get your residence permit.

Do I need a residence permit? ➞

Step 1: Get health insurance

The KSK is not a health insurer. You must choose health insurance yourself, and the KSK will pay for half of it. You can choose any public health insurance1. In some cases, you can also choose private health insurance.

If you don't have health insurance yet, talk to a health insurance broker. Health insurance is complicated for freelancers, and it's easy to make mistakes. A broker will help you choose the right insurance for your needs. Tell your broker that you plan to join the KSK.

While you wait for the KSK's decision, you also need health insurance. During that time, it's better to have public health insurance to avoid KSK backpayments.

When the KSK accepts you, you might need to switch to public health insurance. In some cases, you can also keep your private health insurance.

Step 2: Fill the registration form

Fill the registration form and submit it. This takes a few seconds. If the KSK accepts you, your coverage starts from the date you fill this form1, 2.

KSK online registration form ➞

You will get a confirmation email a few minutes later. You will get another email with a reference number (Aktenzeichen) a few hours later. You need this number when you fill the application form.

After you fill this form, you have 4 weeks to send the required documents1.

Step 3: Fill the application form

Download the application form and fill it. This takes around 1 hour. You must know your social insurance number and your tax ID.

The application form is in German. The instructions are at the end of the form. These English instructions can help.

Form instructions (in German)

Step 4: Collect the required documents

Collect the required documents. This takes a few hours.

These documents must prove that you meet the KSK requirements. If you prepare well, your application will go faster.

You can hire an expert to review your documents. They can improve your chances of getting accepted.

Step 5: Send everything to the KSK

After you fill the registration form, you have 4 weeks to send your documents.

There are two ways to send your documents:

- By post (recommended)

Put all your documents in an envelope, and send it by registered mail to Künstlersozialkasse, Gökerstraße 14, 26384 Wilhelmshaven. - By De-Mail

If you have a De-Mail account, you can use it to send your documents. It's easier to apply by post, but De-Mail is useful if you are currently travelling, and you can't receive post.

Print all your documents on A4 paper. If you have documents in other sizes, make an A4 photocopy. Do not staple the documents. They will be scanned page by page1.

Do not include books, pamphlets, business cards, CDs, DVDs or USB drives, only A4 documents. If you want to show external websites, print screenshots of them.

Step 6: Wait

The KSK will answer by post. It takes 1 to 6 months1.

While you wait, you can send more documents to support your application. Just include your reference number.

They will probably ask more questions, or require more documents. Don't take it personally. Answer their questions quickly. It shows that you care, and it makes them work faster.

You have around 4 weeks to answer before they delete your application. Most KSK applications are rejected because applicants are too slow.

Required documents

You don't need to include every document in this list. You must only prove that you meet the KSK requirements. You must help a stranger understand what you do, how you earn money, and why you are eligible for the KSK.

Application documents

- KSK application form

The German instructions are at the bottom of the form. This English guide shows you how to fill this form. - Passport

Include a photocopy of your passport. - Residence permit

If you need a residence permit to live in Germany, include a photocopy of it. - Direct debit authorization

This allows you to pay the KSK automatically, instead of making manual bank transfers. It's optional, but recommended.

Proof that you are an artist, publicist or art teacher

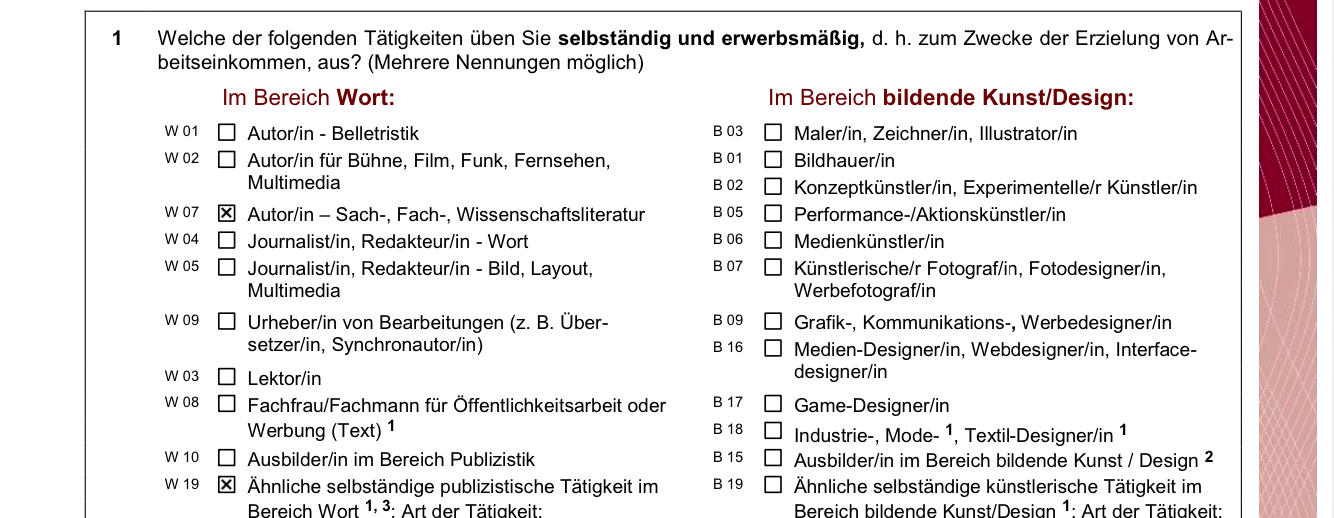

When you fill the KSK application form, you must select one or more activities. You must include proof for each of those activities, so don't select too many of them.

- Examples of your work

For example, websites, art, photographs, content that you have published, newspaper articles about your work, concert tickets. Anything that proves that you do creative or journalistic work. - Proof of your creative career

This proves that you are a trained artist. For example, school diplomas, scholarships, certificates, and prizes you have won. - Membership to artistic or journalistic associations

This proves that you are a professional artist. For example, if you are part of one of these associations, include your certificate of membership. - Letters of reference from your clients

For example, a letter from a client that explains what kind of work you do for them1. - Advertising material

For example, posters for your shows, photos of you on stage, business cards, social media profiles, or a website that advertises your services. Posters from big venues and ads in famous magazines help a lot.- Personal website

If possible, your personal website should show that you sell your services.

- Personal website

These documents must be less than 1 year old. The documents can come from another country1.

Proof that you make money with your work

These documents prove that you make money from artistic activities. They are also used to estimate your future income, and calculate your KSK contributions.

- Invoices with bank statements

Include invoices for your artistic or journalistic work. For each invoice, include a screenshot of the bank transaction. You must prove that the invoice was paid. - Contracts

Include the full contract, with the signature. - Other sources of income

For example, affiliate income and Patreon sponsors. If your source of income is not clear, explain it in a separate document. This helps the KSK understand what you do.

These documents must be less than 6 months old. The documents can come from another country1.

Health insurance documents

- Proof of health insurance (Mitgliedbescheinigung)

You get this from your health insurer, or from your health insurance broker. If you don't have health insurance yet, get a vorläufige Mitgliedsbescheinigung from any public health insurer, or ask a health insurance broker to help you choose health insurance.- Public health insurance exemption form

If you want to keep your private health insurance after you join the KSK, include this form. - Private health insurance contract

If you want to keep your private health insurance after you join the KSK, include your private health insurance contract.

- Public health insurance exemption form

Documents for students

If you are a student, you need these documents.

- Enrolment certificate (Immatrikulationsbescheinigung)

You get this from your university after you pay your registration fees.

Documents for parents

If you have children, you need these documents.

- Proof that you are a parent (Nachweis der Elterneigenschaft)

For example, your children's birth certificates, recent tax assessments, or proof that you get child allowance1.

Documents for teachers

- Proof of artistic education

If you are a teacher, you might need this document. On page 3 of the application form, check if your profession requires it.

After you join the KSK

Backpayments

When the KSK accepts you, your membership starts on the date you applied. You must pay health insurance and pension insurance for the time you waited. If they take 5 months to accept you, you must pay KSK contributions for those 5 months.

What happens depends on the health insurance you had while you waited:

- If you had public health insurance, you can get a refund from your health insurer. You can use your refund to pay the KSK. The cost will be almost the same. If you earn over 58,050€ per year, you could pay a little more.

- If you had private health insurance, you can sometimes

get a refund from your health insurer. You can use your refund to pay

the KSK backpayments. If you don't get a refund, you will pay twice for

your health insurance for the months you were waiting.

- If you had expat health insurance, you can sometimes get a refund from your health insurer.

You pay every month

You must pay the KSK every month. There are two ways to do it:

- Automatically with a direct debit authorization. When you apply for the KSK, include this form. This is the easiest way.

- Manually with a bank transfer.

Costs depends on predicted income

Every year, you must tell the KSK your predicted income for the next year. The KSK uses your predicted income to calculate your monthly payments. This is called the Jahresmeldung. You do it online1.

If your predicted income is wrong, it's okay.

- If your predicted income is too low, you pay less than you should. The KSK will not ask you to pay more1. Good for you.

- If your predicted income is too high, you pay more than you should. The KSK will not give you any money back1, 2. Bad for you.

- If your prediction is really wrong, then you can make a correction (Änderungsmitteilung). The KSK will adjust your future payments. They will not ask you to pay more for the past months. They will not give you any money back.

- If you make bad predictions on purpose, the KSK can fine you up to 5,000€1, 2. They can also kick you out. They can't ask you to pay more for the past months.

There are random audits

Every year, the KSK verifies 5% of its members. They choose at random. If they verify you, you have 4 weeks to send them your tax declarations of the last 4 years1, 2. They will check two things:

- you still meet the KSK requirements

- you did not lie about your predicted income

When you leave Germany

If you leave the European Union, you can usually get a refund for your public pension insurance payments. You only get the part that you paid (9.3% of your income), not the part that the KSK paid.

If you can't get your pension payments back, you will get a German pension when you retire, even if you live in another country.

Questions and answers

Can I have private health insurance with the KSK?

It depends.1 You can only have private health insurance if…1, 26

- You were a freelancer for less than 3 years§3.2, §6

- or you earn more than 64,350€ per year for 3 years in a row.§7

Your private health insurance must offer similar coverage to public health insurance. Expat health insurance is not accepted.

The KSK will pay half of your private health insurance1. They will pay up to 9.65% of your income; half of the cost of public health insurance. If your health insurance costs more than that, you pay the extra cost alone.

You must pay the private health insurer yourself. The KSK will not give you money back, but they will lower your pension insurance payments1.

For most KSK members, private health insurance is a bad idea. Public health insurance is a better, safer option for you. Private health insurance only makes sense if you have a very high income, and you don't plan to have children.

If you are not sure about this, talk to a health insurance broker. They will help you choose the best health insurance for your needs.

Can I have another source of income while in the KSK?

Usually, yes. It depends on what you do1:

- Freelance artist + regular job

If you are a freelance artist and an employee, you can usually stay in the KSK.- If your job is a minijob

If your job pays less than 450€ per month, the KSK pays for half of your health insurance, and half of your pension insurance. Your job makes no difference1. - If most of your income is from your job

It depends on how much you earn from your job1, 2.- If your job pays under 42,300€ per year

The KSK pays half of your pension insurance for your freelance income. Your employer pays half of your pension insurance for your employee income. Your employer pays half of your health insurance. The KSK does not pay for your health insurance. - If your job pays over 42,300€ per year

You get kicked out of the KSK. You earn too much as an employee.

- If your job pays under 42,300€ per year

- If most of your income is from freelancing

The KSK pays half of your pension insurance for your freelance income. Your employer pays half of your pension insurance for your employee income. The KSK pays half of your health insurance. Your employer does not pay for your health insurance.

- If your job is a minijob

- Freelance artist + other freelance income

It depends on how much other freelance income you have1.- If your other freelance income is less than 450€ per month (1,300€ in 2021 and 20221)

The KSK pays for half of your public pension insurance, and half of your health insurance. - If your other freelance income is more than 450€ per month (1,300€ in 2021 and 2022)

The KSK pays for half of your public pension insurance. It does not pay for half of your health insurance. This could change soon1, 2.

- If your other freelance income is less than 450€ per month (1,300€ in 2021 and 20221)

- Freelance artist + full time student

The KSK pays for half of your public pension insurance. It does not pay for your health insurance.

Does my health insurance cover my family?

Yes. You have the same benefits as everyone else. If you have public health insurance, it covers your children, and your unemployed spouse (Familienversicherung). You have the same benefits as other people with public health insurance.

If you have private health insurance, you usually need to pay more to cover your family. The KSK does not pay for this. In this case, you should consider public health insurance. Talk to a health insurance broker. They will help you decide.

Do I get unemployment benefits?

No. Unemployment insurance is optional for freelancers. The KSK won't help you pay for it.

Need help?

There are people who can help you apply for the KSK. They can review your documents, answer your questions, and talk to the KSK for you.

A consultation costs between 75€ and 200€. It's a tax-deductible expense, so keep the receipt1.

Contact the KSK

If you speak German, you can call or email the Künstlersozialkasse.

Organisations for artists

Many organisations offer free consultations, support and workshops for artists. Before you pay for an expert, check if you can get help for free.

List of organisations — Kreativ Kultur Berlin

Künstlersozialkasse experts

- Alex Holz at Kulturspace

KSK and health insurance expert, native English speaker. His consultation fees are low. Alex helped me write this guide. - Kathleen Parker at Red Tape Translation

Relocation consultant with a lot of KSK experience1, native English speaker. Their consultation fees are low. Kathleen reviewed this guide. - Andri Jürgensen (Kiel)

Lawyer for artists and KSK expert. He speaks English1. - BKMB Medien und Künstlerberatung

KSK and pension experts. They speak English. - BIGmedia (Munich)

General consulting for freelance artists. - DKMB

Insurance broker and KSK expert. Alexander Schwartz speaks English. - Freie Wildbahn (Arnsberg)

KSK experts. They speak English. - Expats in Wonderland

Relocation agency with KSK experience. They speak English. - Inbound media service

KSK expert. They speak English. - MKK Consult

Consultant for freelancers in arts, media and culture. KSK expert. He speaks English.

Communities who can help

- KSK — Künstlersozialkasse on Facebook

Unofficial group for KSK questions. You can also ask questions in English. - Berlin Freelancers on Facebook

Group for general questions about freelancing in Berlin.